If you are a contractor, then you know that you need to have a performance bond to get most jobs. But do you know why this is the case? In this blog post, we will discuss the reasons why contractors are required to have a performance bond. We will also talk about what happens if the contractor fails to meet the terms of the bond.

What is a performance bond?

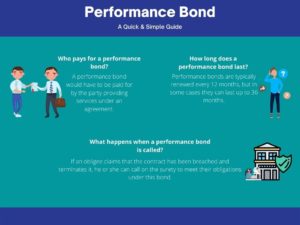

A performance bond is a surety bond that is required to provide financial assurance that the contractor will perform the work according to the terms of the contract. If the contractor fails to perform, the owner can claim the bond and receive compensation for any losses incurred.

How does a performance bond work?

A performance bond is a type of surety bond that is typically required by project owners to protect themselves against financial loss if a contractor fails to complete a project according to the terms of their contract.

Who can get a performance bond?

The answer may surprise you.

You may think that only big businesses can get performance bonds, but that’s not the case. Any business that is contracted to perform a service can get a performance bond.

This includes small businesses, startups, and even sole proprietorships.

How do I apply for performance bonds?

You can apply for performance bonds through a surety company. The process usually involves the submission of an application, along with any required documentation. The surety company will then review the information and decide on whether or not to provide the bond.

Who benefits from a performance bond?

The entity that requires the bond (the obligee) is the one that is protected by the bond. If the contractor does not complete the project or meet the terms of their contract, the obligee can claim the bond and receive compensation for any losses incurred.

When should I ask for a performance bond?

The answer to this question depends on the specific project and situation. In some cases, it may be required by the contract or by law. In other cases, it may be a good idea to request one from the contractor to protect yourself financially.

What happens when a performance bond is called?

If a contractor defaults on their obligations under a construction contract, the owner can claim the performance bond. The surety company that issued the bond will then investigate the claim. If the surety company finds that the claim is valid, they will pay the owner up to the full amount of the bond. The surety company will then attempt to recover the money from the contractor.

Who is a performance bond intended to protect?

A performance bond is a tool that is used to protect the interests of the obligee. If the contractor fails to perform its obligations under the contract, the bond will provide financial security for the obligee. A bond is a form of insurance that protects the obligee from financial loss if the contractor fails to meet its obligations. In most cases, the surety company that issues the bond will be responsible for paying the obligee if the contractor defaults on its obligations. A performance bond is a valuable tool that can protect the interests of the obligee if the contractor fails to perform its obligations under the contract.

How much does a performance bond cost?

The answer to this question depends on a few factors, including the type of bond, the amount of the bond, and the creditworthiness of the applicant. Generally, the cost of a performance bond ranges from one to three percent of the total project value.

Can you get a performance bond with bad credit?

This is a question we get often from business owners. The short answer is yes, you can get a performance bond with bad credit. However, the process is often more difficult and the cost is usually higher.